You might be wondering, “is this a freaking clickbait?

Japan? Not into customization? No way!”

But no, this is a legit question. Being the largest used car parts seller in Japan, we have insight into many market trend & reports. But of course just by looking into those data itself might not tell the full story, so let’s dig into the internet and try to get some information out of it.

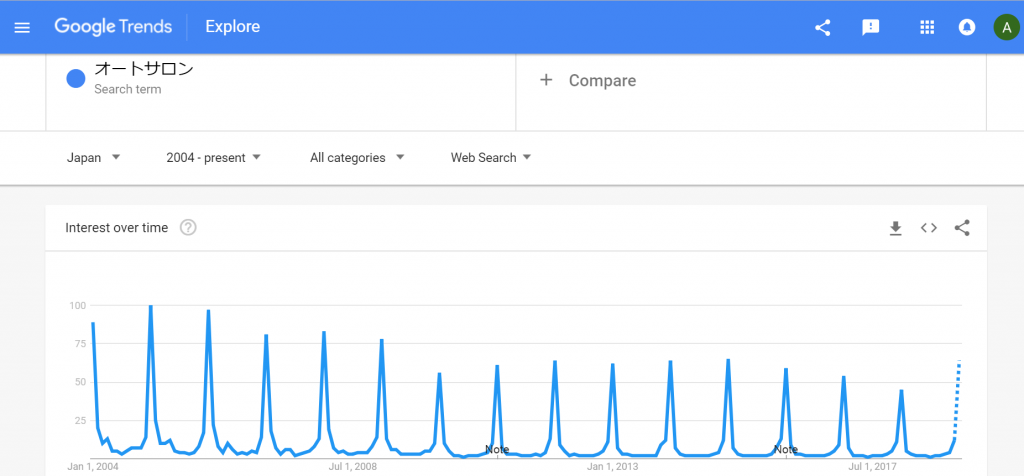

1. Interest in Auto Salon

Let’s first start by looking at the annual interest for Tokyo Auto Salon. As Tokyo Auto Salon is the go-to aftermarket exhibition for aftermarket parts lover, checking the statistic around Tokyo Auto Salon might shed some insights into the customization trend in Japan.

The reasoning is a simple one, if the interest in Auto Salon increases, it indirectly shows the interest in car customization is still going strong.

Graph: Keyword Search Trend for Tokyo Auto Salon since 2004

Let’s start by looking at the graph provided Google Trend. The interest on the Tokyo Salon seems to have dropped steadily since 2006 and dramatically in 2008 with some revival of interest the year after.

So does the continuously reduced searches for Auto Salon means the loss of interest?

Maybe and maybe not. The reduced in search might mean, instead of searching for the “Auto Salon”, users go straight to Auto Salon’s website by typing the URL instead. However, there is a little chance of that happening as Auto Salon is a once a year event, rarely anyone will still have their URL address saved on their browser.

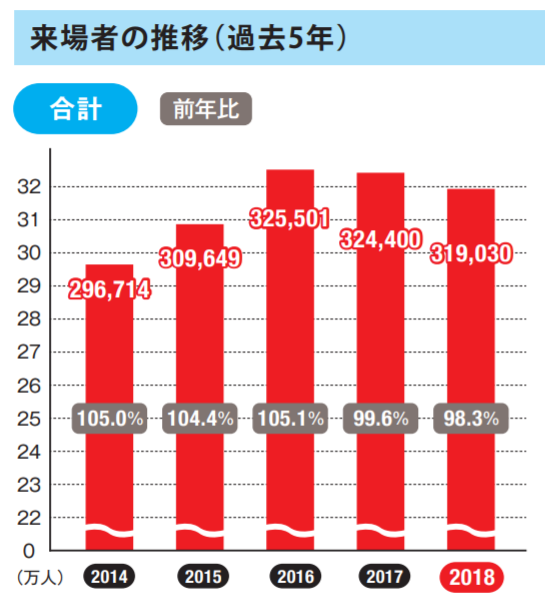

That said, let’s look at the number of visitors of Tokyo Auto Salon in the past few years. We can get this data by looking at the exhibition report created by Tokyo Auto Salon Organizer. As the report only goes back to 2014, we can only compare the visitors’ number in the past five years.

Looking at the graph above, you will notice two things. The number of visitors had been increasing until 2016 before starting to decrease. Since there is literally only five data points and the data do not separate Japanese from foreigners a lot of conclusions can’t be made.

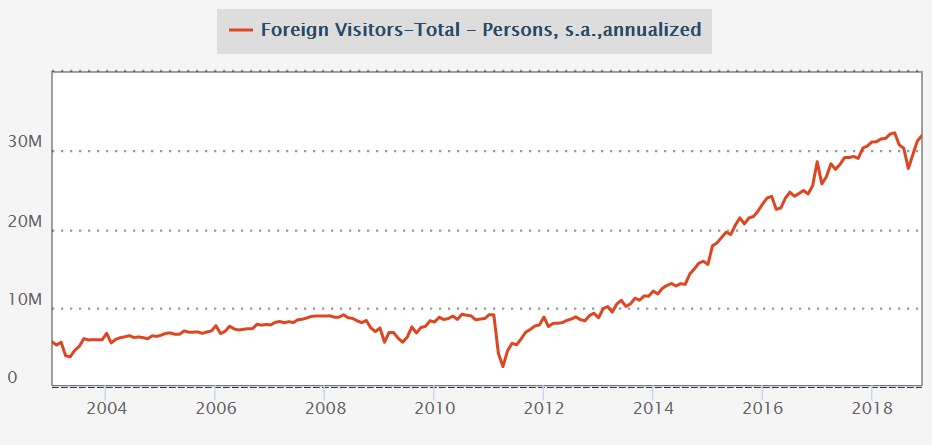

The reason why knowing the number of foreigners who are attending the Tokyo Auto Salon is important because the numbers travelers to Japan have more than tripled in the five years. This can clearly be shown on the graph provided below:

Graph: Number of tourists to Japan overtime (Monthly)

And since any car enthusiast will love to visit the Tokyo Auto Salon, it is not impossible to imagine these tourists flocking to the Auto Salon hence playing a significant role in increasing the number of attendees to the Auto Salon.

That said, the correlation does not continue after 2016. Thus a definite conclusion can’t be made.

2. Interest in Part makers

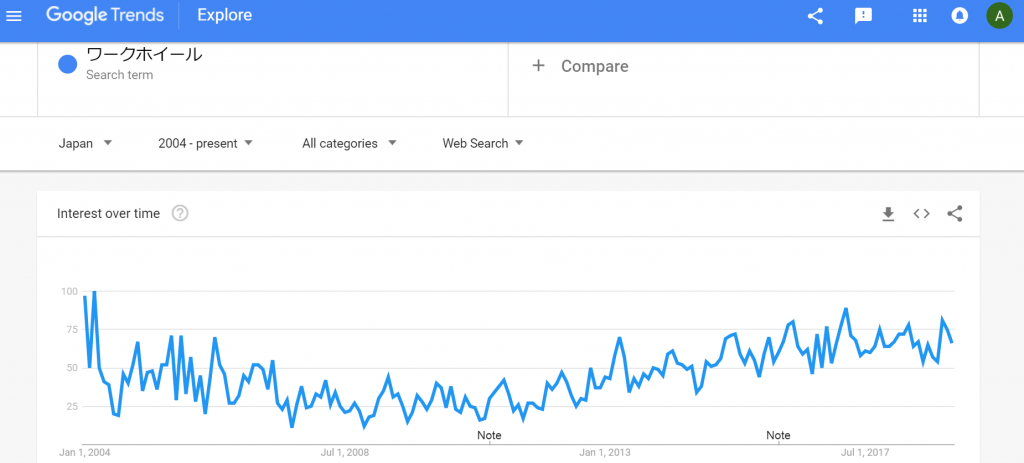

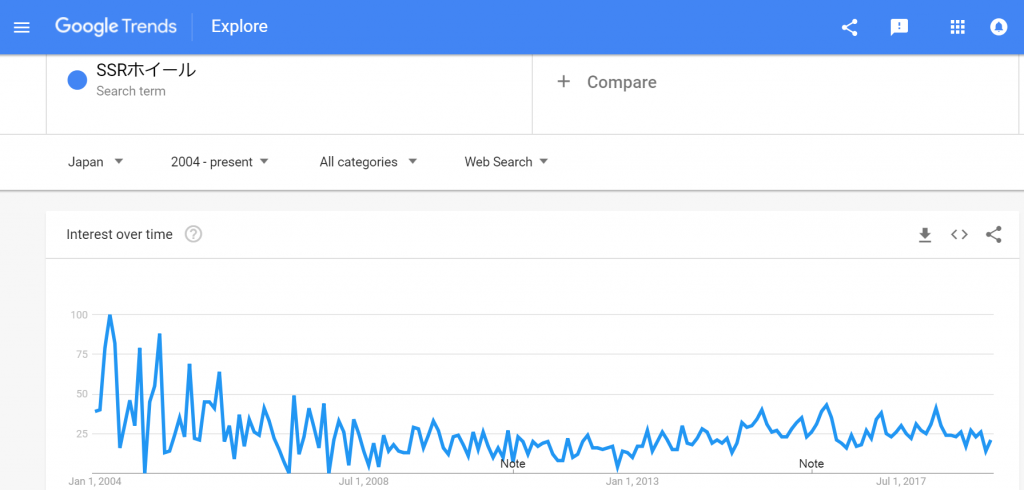

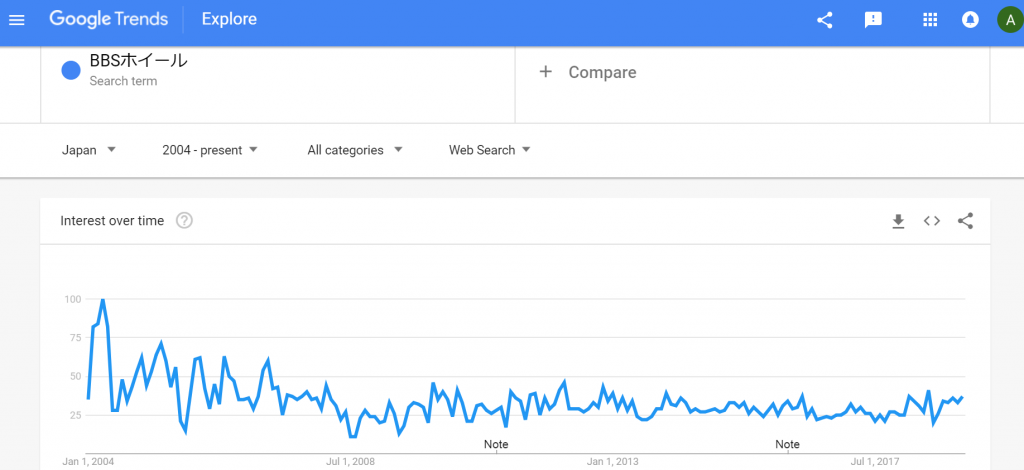

Another way to gauge the current condition is by looking at the interest of big brands names such as WORK, SSR, BBS & Garson in Japan. We expect an upwards trends for most makers if the market is going strong and a downward trend for most makers if the market is weak.

However, as always life is never simple, as data from different makers show different results.

For example, we can see the interest in work wheels took a slow dive from 2004 until around 2010 while it climbed back up slowly. This show WORK has lost some interest from the public and managed to regain it’s favor years after. However, trend similar to this was not seen in both BBS and SSR wheels.

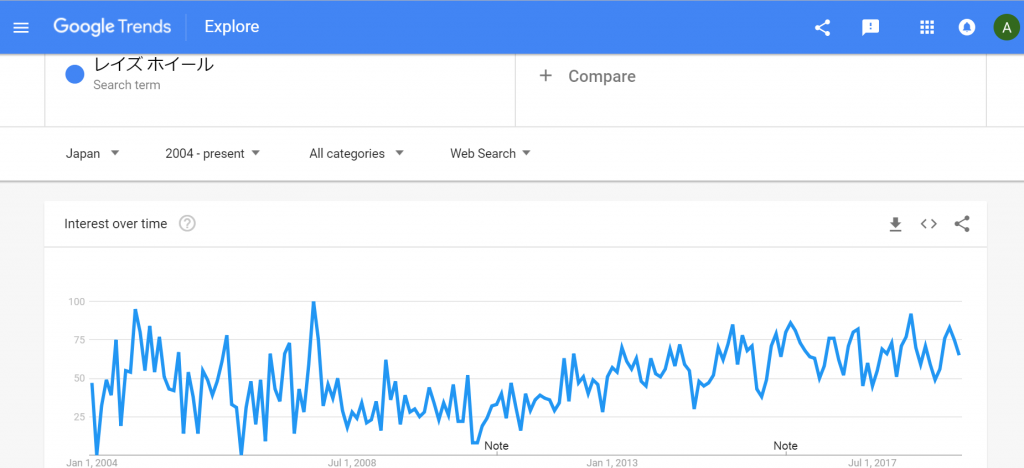

As you can see, all wheel makers experience a similar decent since 2014. This could mean that, after year 2004, there seems to be an overall struggle in the wheel industry. However, the similarity ends at the later years. This could mean that despite the market recovering, SSR wheels and BBS wheels are losing their ground in the wheel making industry. Since it’s really hard to tell the overall picture of the wheels market, let’s take Rays into the picture as well.

By looking at interest on RAYS Wheel’s we can see a similar trend like WORK, but unlike WORK, they did not take a dive until around 2006. Not only that, but they also seem to recover quite fast when compared to WORK, albeit less dramatic. Based on the trend we see on these four wheels makers, a simple conclusion can be made, it seems that the wheel market in general, was in decline since 2004 while stronger players such as RAYS and WORKS were able to beat the odds, more so for RAYS.

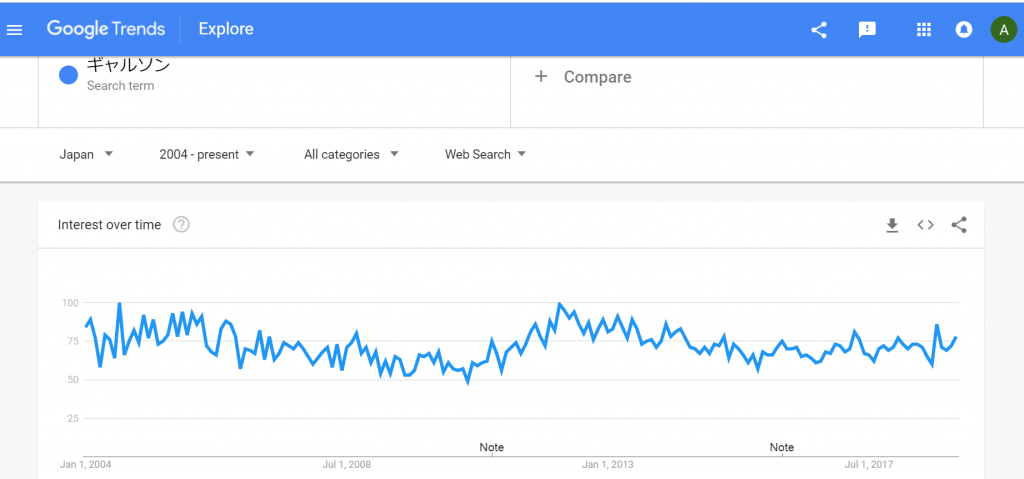

Taking a look from another perspective, we look at Garson, a large parts maker in Japan that specializes in all range of interiors and exteriors. Based on their trend, they seem to have some ups and downs throughout the year. So far, there don’t seem to have any evidence back up the hypothesis that the Japanese are losing interest in car customization. However, it does show that there is little to no growth in the interest in car customization

3. Interest in Parts Retailers – Autobacs & UP Garage

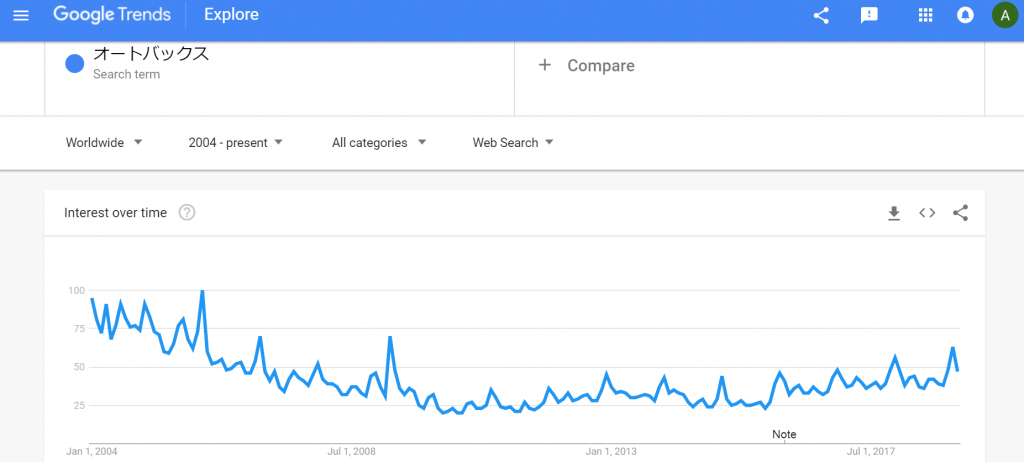

I am sure none of you will argue that Autobacs is one of the largest car parts sellers in Japan. So looking into the interest in Autobacs will definitely reveal some bigger pictures into the Auto industry in Japan.

Like the assumption made after observing the graph from Wheels makers, the interest for Autobacs seems to confirm that the Japanese Auto Market was having some struggle ever since 2004. The market seems to have stabled after 2008 with little small up and downs since then with a slow sign of recovery. Let’s look at the graph for UP Garage next.

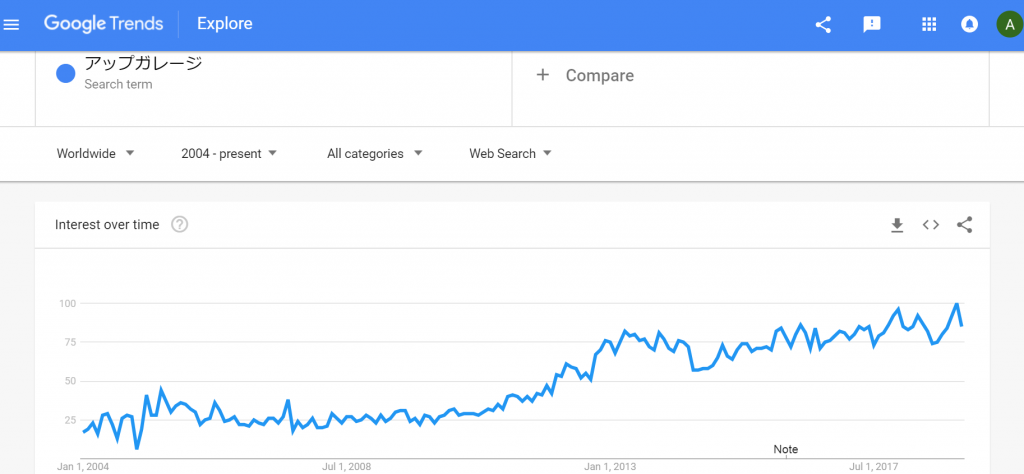

On the contrary, UP Garage seems to have the opposite effect, the interest for UPGarage seem to have been growing ever since 2004, so does that mean the assumptions we made so far have been wrong?

Well, not so.

It actually shows that it was not the Auto Industry that was struggling but the Japanese market as a whole. Why so? Because UPGarage is a used auto parts seller and when do people start gaining interest in used parts? – When the economy is not doing so well

In conclusion

Based on all the graph we have seen so far, we can assume that the interest in the Auto Parts has not fallen. However, it also shows that there isn’t any significant growth behind it. We also can conclude that the economy of Japan since 2004 has been struggling for years, which as a result, impacted most players in the Auto Industry except UPGarge. In order words, car customization is still a thing in Japan but it doesn’t seem to be growing. Coupled with the aging population and reduced birthrate, the decline in the car customization culture in the near future do not seem that far fetched.